Charge capture is the process through which services rendered by healthcare providers are translated into billable charges. This critical step in the healthcare revenue cycle ensures that all services are accounted for and billed appropriately, directly influencing the reimbursement rates from payers.

Effective charge capture practices can significantly boost the financial health of healthcare organizations by maximizing revenue and reducing the time between service delivery and payment receipt.

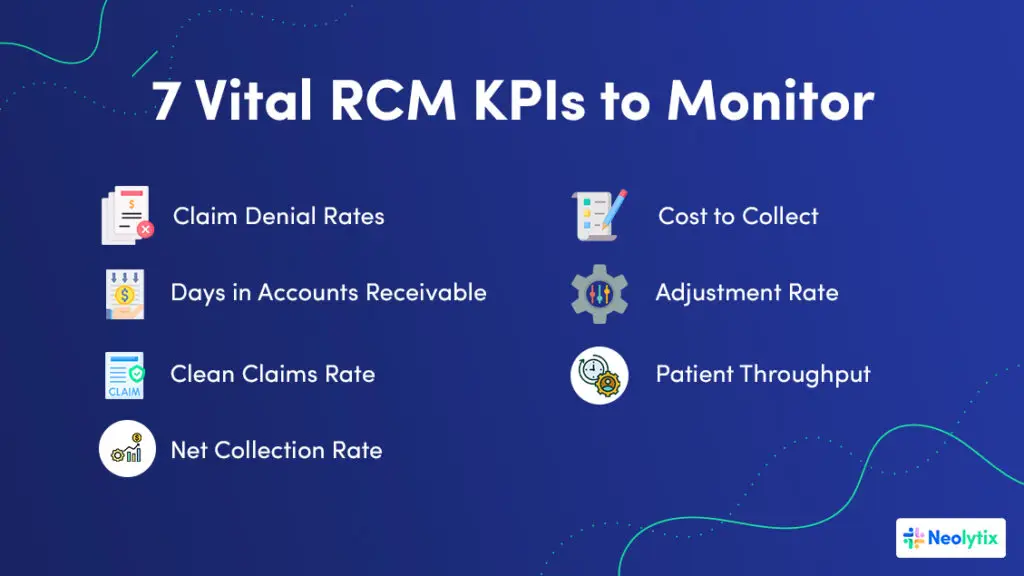

Understanding Revenue Cycle Metrics (KPIs)

Revenue Cycle metrics or KPIs are quantifiable measures used to gauge the effectiveness of financial processes within healthcare organizations. These metrics are critical for assessing how well a healthcare organization manages patient care billing and payments from initial registration to final remittance.

Accurate KPI tracking is vital for diagnosing financial weaknesses and pinpointing operational bottlenecks within a healthcare organization. Without precise data, management cannot effectively address inefficiencies or capitalize on areas performing well.

Modern tools and software have become invaluable in this regard, enhancing the accuracy and accessibility of KPI data, thus allowing managers to make informed decisions quickly and efficiently.

Core KPIs for Healthcare Revenue Management

1. Claim Denial Rates

The claim denial rate is a critical KPI that measures the percentage of claims denied by payers. A high denial rate can significantly disrupt cash flow and indicates issues in the billing process, such as coding errors or inadequate documentation.

Strategies to Reduce Denial Rates: To improve claim acceptance, healthcare organizations can implement enhanced coding training, perform regular audits to catch and correct common errors, and use software that flags potential denials before submission. These steps help ensure that claims are accurate and compliant, reducing the likelihood of denial and boosting financial health.

2. Days in Accounts Receivable (A/R)

Days in Accounts Receivable (A/R) indicates the average number of days it takes a healthcare organization to collect payments owed. This metric is crucial for both measuring and managing cash flow; the longer the payment takes, the greater the strain on financial resources.

Techniques to Decrease A/R Days: Streamlining billing processes, ensuring timely claim submission, and employing proactive follow-up strategies on outstanding invoices can significantly reduce A/R days. These actions help maintain a healthier cash management system, ensuring funds are available for operational needs and investments.

3. Clean Claims Rate

The clean claims rate measures the percentage of claims paid on the first submission without being rejected or sent back for correction. A high clean claims rate is indicative of efficient billing practices and directly correlates with faster payment times.

Achieving a Higher Rate: Regular training for coding staff, investing in up-to-date coding software, and meticulous documentation practices are essential for maintaining a high clean claims rate. These efforts reduce the need for rework and help secure quicker reimbursements from payers.

4. Net Collection Rate

Measuring Revenue Efficiency: The net collection rate assesses the percentage of total potential revenue that is actually collected, accounting for necessary write-offs and adjustments.

Optimizing the Rate: To enhance the net collection rate, healthcare organizations should focus on improving patient payment mechanisms, renegotiating payer contracts, and optimizing charge capture processes to ensure no revenue opportunities are missed.

5. Cost to Collect

The cost to collect is a crucial metric that evaluates the expenses associated with collecting payments. It reflects the efficiency of the revenue cycle management process.

Reassessing Collection Process Efficiency: Automating routine billing tasks, refining resource allocation, and enhancing staff training can lead to a more cost-effective collection process. By lowering the cost to collect, healthcare organizations can maximize their revenue and reinvest in critical areas such as patient care and technology upgrades.

6. Adjustment Rate

The Adjustment Rate KPI measures the percentage of total charges that are written off by the provider and not billed to the patient or insurance. It provides insights into the financial concessions made by the healthcare facility and can help in understanding the balance between maintaining patient satisfaction and financial sustainability.

Improving the adjustment rate: To manage and potentially reduce the adjustment rate, healthcare organizations can implement stricter compliance checks and more detailed contract management practices. Regularly reviewing the terms and conditions of payer contracts can ensure charges are accurately aligned with payer obligations and minimize unnecessary write-offs.

7. Patient Throughput

This metric evaluates the number of patients a healthcare provider can manage effectively within a specific period. By analyzing patient throughput, organizations can gauge their operational efficiency and identify bottlenecks that may be slowing down patient care processes and impacting revenue cycles.

Improving patient throughput can be achieved by optimizing appointment scheduling systems and reducing patient wait times through process improvements and technology.

By diligently monitoring and optimizing these KPIs, healthcare organizations can achieve significant improvements in their financial operations, ensuring they have the necessary resources to provide high-quality care and meet their strategic goals.

Advanced KPIs to Enhance Financial Strategy

Long-Term Receivables

Accounts Receivable (A/R) over 90 days are a critical measure of financial health, indicating the amount of revenue tied up in long-term receivables. High levels of aged A/R can significantly affect an organization’s liquidity and cash flow, making it difficult to cover operational expenses and invest in growth opportunities.

Intervention Strategies

To reduce aged receivables, healthcare providers can implement more aggressive follow-up strategies, enhance patient communication regarding outstanding balances, and use predictive analytics to identify accounts at risk of becoming overdue. Additionally, offering flexible payment plans and early payment discounts can incentivize quicker settlements.

Patient Financial Responsibility

The shift towards high-deductible health plans has increased the percentage of revenue that comes directly from patients. This shift makes effective patient financial interactions more crucial than ever, as patient payments become a larger component of healthcare revenue.

Strategies for Improvement: Clear communication about financial responsibilities at the point of care is essential. Implementing user-friendly digital payment systems that offer various payment options can improve collections. Training staff to handle financial discussions sensitively and effectively is also crucial, ensuring that patients understand their obligations and payment options.

The Average Reimbursement Rate

The average reimbursement rate, which reflects the average payout per service after payer adjustments, directly influences pricing strategies and overall financial planning. Understanding this rate helps providers adjust their service pricing to ensure sustainability.

To Enhance Reimbursement Rates

healthcare providers should regularly review and renegotiate payer contracts with detailed data on service costs and outcomes. Leveraging comparative data from similar institutions and services can provide strong negotiation leverage, ensuring that rates reflect the true value of the services provided.

Implementing KPI Monitoring for Continuous Improvement

Setting Up Effective Monitoring Systems

Effective KPI monitoring relies on integrating robust IT systems and data analytics. This integration allows for real-time tracking of KPIs, providing healthcare managers with timely insights into their operations and financial status.

Successful implementations often feature automated dashboards that display real-time data on key financial metrics, such as claim denial rates and days in A/R. For example, a healthcare provider might use advanced analytics to reduce their claim denial rates by identifying and addressing common coding errors before submission.

Regular Review and Adjustment of KPIs

The healthcare landscape is continuously evolving, making it essential to regularly review and adjust KPIs to stay aligned with current regulations and market conditions. This adaptability ensures that RCM strategies remain effective and compliant.

Utilizing KPI data for regular strategic reviews can help identify trends and pinpoint areas for improvement. For instance, if the data shows an increase in claim denials due to coding errors, a targeted intervention such as additional coder training or a software upgrade could be implemented.

Leveraging KPIs for Sustainable Healthcare Operations

Monitoring and optimizing KPIs is essential for maintaining the financial health and operational efficiency of healthcare organizations. Effective KPI management helps ensure that resources are used efficiently, regulatory requirements are met, and patient care is not compromised by financial constraints.

Healthcare leaders are encouraged to periodically reassess their RCM strategies, using detailed KPI analysis to identify areas for improvement. Adjusting practices to align with the latest industry standards and best practices is not just recommended; it’s essential for staying competitive and financially healthy.

Enhancing Your RCM Strategy with Neolytix

At Neolytix, we understand the challenges and complexities of healthcare RCM. We offer specialized services that can help streamline your operations, from medical billing and coding to advanced analytics and consultancy. Our team of experts is ready to assist you in enhancing your understanding and capabilities in RCM, ensuring that your organization remains at the forefront of efficient healthcare management.

Reach out to Neolytix today to learn how our Revenue Cycle Management (RCM) and Healthcare automation services can transform your revenue cycle processes.

Complete the form and someone from our team will be in touch with you!