The switch to electronic health records (EHRs), and the need for accurate, compliant billing practices, created a need for a crucial intermediary known as a clearinghouse. The rise of clearinghouse in medical billing marked a transition from traditional paper-based, which imposed significant costs on healthcare due to the manual handling of claim errors and paperwork. A clearinghouse for medical billing ensures the seamless exchange of information between healthcare providers and insurance payers.

Clearinghouses act as electronic facilitators, pre-screening claims for errors and playing a vital role in overseeing the smooth submission of electronic claims, addressing the limitations of traditional postal services.

In this article, we’ll explore clearinghouses, how they function, and their roles within the medical billing process.

What is a Clearinghouse in Medical Billing?

In healthcare, a clearinghouse plays a pivotal role as a centralized hub that facilitates the seamless exchange of information between healthcare providers and insurance payers. Think of it as a diligent mediator ensuring that the language spoken by healthcare providers in their claims aligns flawlessly with the expectations of insurance companies.

A clearinghouse in medical billing acts as a bridge for healthcare transactions. It serves as a centralized platform, intelligently processing and forwarding claims from healthcare providers to insurance companies. This intermediary function is crucial, ensuring that the claims are in a format easily understandable by insurance payers, reducing the likelihood of errors and claim denials.

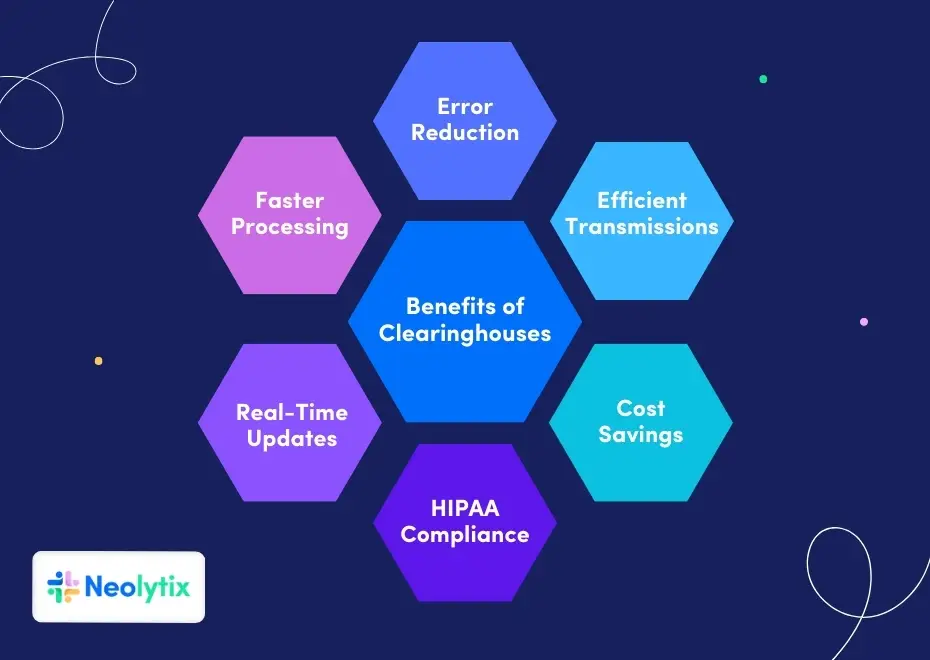

- Error Reduction: Clearinghouses meticulously scrub claims for errors before submission, reducing the likelihood of claim denials and ensuring cleaner, more accurate submissions.

- Efficient Transmission: They streamline the claims submission process by electronically transmitting data, eliminating the need for manual paperwork and accelerating the overall billing cycle.

- Cost Savings: Using clearinghouses proves cost-effective as it minimizes the need for manual handling, paperwork, and phone calls associated with claim errors, ultimately reducing operational expenses for healthcare providers.

- HIPAA Compliance: Clearinghouses ensure secure transmission of sensitive health information, adhering to the standards set by the Health Insurance Portability and Accountability Act (HIPAA), and safeguarding patient data.

- Real-Time Updates: They provide real-time updates on claim errors detected by insurance companies, enabling healthcare providers to address issues promptly and efficiently manage the billing process.

- Faster Processing: Acting as centralized hubs, clearinghouses serve as intermediaries between healthcare providers and insurance payers, offering a centralized platform for efficient claims processing and submission.

What are the Main Functions of a Clearinghouse?

Clearinghouses are not mere conduits but guardians of the claims submission process. Their primary functions include claim scrubbing and checking claims for errors. Claim scrubbing involves a meticulous review of submitted claims, identifying errors, and rectifying them before they reach the desks of insurance companies. This ensures that claims are error-free, significantly reducing the likelihood of claim denials.

Additionally, clearinghouses operate as sophisticated gatekeepers of electronic claims. They embrace advanced technologies to process claims efficiently, ensuring they adhere to industry standards. Implementing error-checking algorithms and compliance checks contributes to creating clean claims ready for submission to insurance companies.

The process flow below is an indication of how typical clearinghouses function:

- Every claim entered into medical billing software undergoes a conversion process, morphing into a file that adheres to the ANSI-X12-837 format, commonly facilitated through Electronic Data Interchange (EDI) protocols for seamless integration.

- The generated file finds its way to your dedicated medical clearinghouse account.

- Before transmission to a payer, the clearinghouse reviews the file (scrubs) for potential errors.

- Subsequently, the file is dispatched to the designated payer.

- Depending on the circumstances, the payer has the prerogative to approve or disapprove the claim.

- Any errors detected by the insurance company are promptly relayed to your clearinghouse, and these updates are seamlessly integrated into your dashboard.

- The transmission process transpires through a secure connection, aligning with the Health Insurance Portability and Accountability Act (HIPAA) stipulations.

What Does a Clearinghouse Do During Claims Submission?

During the claim’s submission process, a clearinghouse performs a delicate dance of validation and transmission. It meticulously checks the claims for errors, ensuring they comply with industry standards and contain accurate information. This not only enhances the chances of claims being accepted but also minimizes the occurrence of claim denials.

In the real-time exchange of claims, clearinghouses act as electronic intermediaries, managing the secure transmission of sensitive health information. The claim transmission process involves not only speed but also accuracy, contributing to a more efficient healthcare claims ecosystem.

As claims move seamlessly from healthcare providers to insurance companies, the clearinghouse checks play a crucial role in ensuring the protection of patients’ health information.

What is the Difference Between an Outsourced Medical Billing Company and a Clearinghouse?

While both clearinghouses and outsourced medical billing companies play essential roles in the revenue cycle, they differ in their scope and focus.

A clearinghouse primarily specializes in the efficient transmission and validation of claims. It acts as a technical intermediary, ensuring that claims are error-free before reaching insurance companies.

On the other hand, an outsourced medical billing company, like Neolytix, offers a comprehensive suite of services beyond claims submission. It takes a more holistic approach, managing the entire medical billing process, from claim creation to payment posting. Outsourced medical billing companies often include services like patient invoicing, denial management, and revenue cycle optimization.

Understanding the difference between the two is essential for healthcare providers seeking to optimize their billing processes. While a clearinghouse ensures the technical accuracy of claims, an outsourced medical billing company takes a broader approach, encompassing the entire revenue cycle for a more comprehensive solution.

Conclusion

Within electronic medical claims, where precision and compliance are paramount, a clearinghouse provides a smoother, more efficient, and error-free claims submission process.

However, clearinghouses do not alleviate all the burdens from billing teams in healthcare organizations. It still demands significant resources to be allocated toward facilitating smooth operations for faster reimbursements.

Neolytix’s coding and billing teams have been helping healthcare organizations maximize reimbursements, reduce costs, and improve cashflows for almost 12 years.

Contact us today for a free demonstration to experience how Neolytix can make a significant impact on your organization’s revenue cycle.